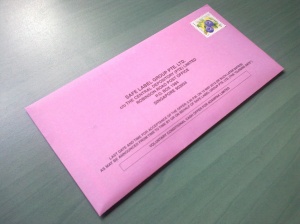

This morning, at 8.30am, I dropped a pink envelope into the Singpost letterbox. Contained in the pink envelope was the acceptance letter to sell off my Adampak stake to Navis Capital. Navis made an offer to buy over Adampak at $0.42/share.

My initial plan was to wait out till around 24th May to accept the offer. However, I accepted the offer much earlier as Navis had acquired 88.76% of Adampak as of yesterday and it was no point holding out any longer. This evening, after posting my letter, news was released that Navis had acquired 91.74% of Adampak and has exercised the right to completely acquire Adampak. It was a “right” timing to post my letter, so to speak.

Now, I have to look for other companies to invest my funds in…

No worry about reinvesting, need to pray harder that STI drops by another 200 points :) I can see some opportunities presenting themselves slowly, the most impt thing is to have cash when you really need them.

you can look at some euro etf like vanguard msci euro or spdr euro 50, high roe of 20%, dividend yield of 4% and relatively cheap compared to the 2008 bottom. They are made up of some of the strongest company like Nestle, Diageo, Total Sa, GSK, Novatis, Vodafone.

Hi shanrui,

As sadistic as it sounds, I’m also hoping the STI drops more!!!

I’m not comfortable with investing in such ETFs such they are denominated in USD. Not comfortable with putting funds in USD. Are they available in SGX?

they are not available in SGX, i think you only have your STI etf… Forex risk is undeniable since all it takes is a QE 3 for USD to depreciate and your returns eroded.

It’s not sadistic to wish to the index to crash. If the Company you own is strong fundamentally, you would wish for lower prices to be able to accumulate more shares. You also are getting a very attractive dividend yield to boot. My view is that everyone should look forward to cheaper prices, but in reality all my friends prefer rising prices, for some funny reason.

Hi MW,

That’s so true. Not only your friends, many people prefer that. When it’s GSS, people rush to buy cheap stuff. But when the market crashes, people flee in hordes.