Bank deposits are giving a paltry 0.05% to 0.1%, hardly enough to beat the raging inflation currently in Singapore. Property prices are still sky-high. Singaporeans have lots of cash and they do not know where to deploy them to make their cash work harder. This is evident from the recent gold scams many fell prey to. Amid this low interest rate environment, real estate investment trusts (REITs) have been the talk of the town as investors chase for high-yielding instruments that give a bang for their buck. However, are investors looking to invest in REITs a little too late for the party? Before we answer that, let us examine a few hard truths.

Firstly, let’s take a look at the price/net-asset-value (price/NAV) and distribution yield of some REITs.

(Source: ShareInvestor)

It can be seen from the table that almost all REITs are trading above or very close to price/NAV. Only three REITs are trading at price/NAV below 0.9. Interestingly, Parkway Life REIT is trading 58% above price/NAV!

The dividend yield of around 4-5% for those REITs still trading below NAV is hardly attractive (provided those REITs are strong fundamentally in the first place!). Blue-chip companies like SIA Engineering, Singpost and Starhub are currently yielding 4.3%, 5% and 4.6% respectively. Kingsmen Creatives, one of my favourite companies, is yielding 4.6%. Some of the companies mentioned like SIA Engineering and Kingsmen give such yields by taking on much lower debt, compared to most REITs do. REITs work by taking on debt and rolling them into the future. A recent article shows that REITs may not be able to cope when interest rates rise.

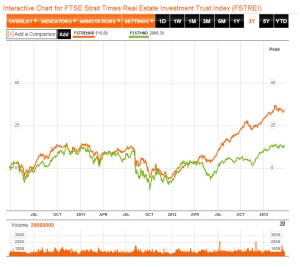

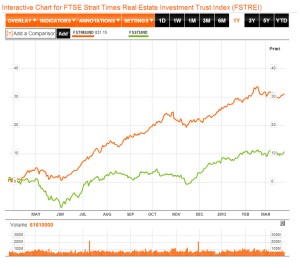

Secondly, below is a three-year comparison and a one-year comparison of the Straits Times Index (STI) and the FTSE Strait Times Real Estate Investment Trust Index (FSTREI):

It can be seen from the charts that up until around mid-April 2012, the FSTREI and STI have been moving almost in tandem. After mid-April 2012, the FSTREI has been going much higher than the STI at a burgeoning rate!

Thirdly, in early January this year, Business Times reported that “S’pore Reits gave highest yields at lowest volatility in 2012“. Many were talking about this article in the streets and during seminars I went to. People who do not invest wanted to buy REITs for their high yields, without understanding the risks behind it. It was like in 2000 during the technology bubble where everyone wanted to buy stocks that had a “.com” in their name.

Last month, Singapore Exchange (SGX) reported that “Singapore’s REIT index has outperformed Japan and Australia across 5 years“. This can further increase interest in REITs and cause the premium above NAV to rise further. I would not be surprised if most REITs, including those not fundamentally strong, are traded at 50% above NAV in time to come!

Lastly, many REITs recently went IPO, including the most recent Mapletree Greater China Commercial Trust IPO. Singapore Press Holdings (SPH) and Overseas Union Enterprise (OUE) are also contemplating spinning their assets into a REIT. Such IPO frenzy would not take place if the REIT market was depressed, like during the financial crisis of 2008/2009.

In any bubble, new “investors” push up the price of the asset due to the influence of other “investors” who are already making money from it. This herd behaviour of buying REITs for their distribution yield may come to an end one day and it can be scary! Warren Buffett’s quote come to my mind: “Only when the tide goes out you discover who has been swimming naked.”

Great article! Reits have been outperforming STI last year and fundamentally need to be supported by Yield, this is the take away

Hi Paul,

Thank you for your support!

Great article

Thanks!

Hello,

I read your article with a pinch of salt, as I am considering to reduce/cash out my Reits holding.

In your mind, would appreciate if you can share which are your “not fundamentally strong” Reits?

Are all Reits (in your list) reach their historical high?

Thank you.

Best Rgds …… Kent

Hi Kent,

You can refer to http://reitdata.com/. They provide very good data in terms of distribution yield and gearing ratio. From there, you can filter out the weak REITs. I look at gearing ratio, interest coverage ratio, property yield, distribution yield and how the DPU has grown over the years. To value the REIT, I look at price/NAV.

Sorry I’m not sure if the REITs in my list have reached historical high. I’ve not been keeping track of that.

Hope I was of help.

Hello,

I agreed that REIT is over performing this 2 years but what you say in the entire article is not absolutely fair for Reits.

1. Plp invest in reit is because REIT is a must to distribute 90% income yield to units owner where shares is not, as its subject to major shareholders decision. So in terms of income yield wise, REIT is more predictable.

2. If talking about price/nav, many shares are of a few times more than reits. Take for eg, genting is 2.75 price/nav. You can’t just value a Reits by price/nav, it’s a bit shallow of doing that. You may want to look further at the property yield, distribution yield, percentage of gearing etc.

3. If talk about gearing ratio, some shares are even > than 2 times gearing. But reits is only keep at < 35%.

Of cause when market crash, not only reits will falls, as blue chips will falls too.

Having said that, I agreed that REIT is over perform this 2 years but not as that worse as what the article said.

Certainly I will not recommend plp to buy reits now as its over price but will hold as long market is looking at the uptrend side

Hi Edmund,

Thanks for your points. These are my views:

Price/NAV is a quick-and-dirty way to value REITs. Why I mentioned price/NAV is that REITs are not something one buys for capital gains. It’s more for income. Thus, buying a REIT at say, 58% premium, is certainly stretching too much, I feel. REITs can trade above NAV for many reasons – it’s more liquid than physical properties, more “popular” (retail REIT vs industrial REIT), etc. But a huge premium might say a lot about the market in general. We cannot compare companies’ NAV to REITs’ NAV. They are different. Genting doesn’t have buildings alone. It owns the casinos, etc. However, we can value banks and property counters using price//NAV. I look at other metrices (like those you said) as mentioned in my previous comment to Kent.

Regarding gearing, it is true that REITs having 35% gearing is not that “high” compared to other companies. Even when we buy properties, we can take on higher “gearing”. However, like you said REITs have to distribute 90% income to unitholders. That causes the problem. REITs to roll-over their debt. There isn’t much to be retained unlike companies. Thus, when interest rates rise, REITs might have a lower interest coverage and may be unable to pay their debt. During an economic crisis, the heavily-leveraged REITs will get hit badly like what happened during the 08/09 crisis. Yes, REITs can do equity financing but to the detriment of minor shareholders, unless it is a rights issue (even in that case, some would not participate due to lack of funds and will get diluted).

Hi FFN,

You should use STI Total Return to compare: TSTIS:IND

Do us all a favour by posting the 5-yr comparison image too. Thanks.

Hi momo,

The STI Total Return index comprises of dividends as well?

Hi FFN, thats right. :)

Ah I see you haven’t updated the post to include STI TR and 5-yr comparison.

Hi momo,

I can only see the 1 year return for STI TR at http://www.bloomberg.com/quote/TSTIS:IND. How to see the 5-year chart? Is that the correct link?

Sorry forgot to include factsheet link

http://www.ftse.com/Analytics/FactSheets/Home/DownloadSingleIssue?issueName=SGXSERIES

Hi,

http://www.bloomberg.com/quote/TSTIS:IND/chart

Eh.. if you knew how to create those images in your original blog post, how come you don’t know how to see the chart for TSTIS:IND ??

Hi momo,

I was in a hurry so I missed it. Thanks for the link. Regarding how I got the images for the original blog post, I took some time to get to it. I think I googled for it.

Regarding 5-year comparison, STI and the ST REIT Index are at the same percentage level now. However, ST REIT Index has a higher percentage gain from the 2009 lows compared to STI as ST REIT Index dropped more than the STI.

Hi FFN,

The point I would like to highlight is, don’t just see that ST REIT gained more from the lows. Compare how it fared during the downturn too. The STI TR 5-yr return is better than ST REIT. All these (past and recent) may just be reversion to the mean.

Hi momo,

Roger that! Thanks!

Good write-up, I am regular visitor of oneas website, maintain up the nice operate, and It is going to be a regular visitor for a long time.

Thanks Sofiya for your support and for visiting my site!

Thanks for your article, looking back FTREITs index peaked at late April 2013 and then dropped over 20%, so you made a nice call of “REITs bubble”! I have two questions on SREIT investment:

1. Are REITs stocks less risk than average STI stocks in general?

2. Fair values of SRETI stocks, based on price/nav?

thannks

David

Thanks David! The answer to your questions:

1) REITs are riskier as they work on debt, unlike stocks which generally generate cash and use re-invest them.

2) Yes, asset-heavy stocks like bank and property companies and REITs are valued based on Price/NAV.

Hope this helps.